In the last several months the US has seen a rise in inflation, plummeting equity markets, and companies enacting hiring freezes and layoffs as they plan for an uncertain economic future. Looking at historical events, we know that rising interest rates can trigger a recession. Although these are warning signs, we are not technically in a recession yet.

But the impending prospect of recession and further rate hikes is having a measurable effect on the US consumer, in the form of decrease in demand. Consumers are deferring larger, fixed investments in order to conserve cash to keep up with living expenses.

One of the things to consider, which differentiates this period in the economy, is that consumers have more cash than ever before. At the beginning of 2020, there was $13.7 trillion in the hands of U.S. consumers. The savings rate during the pandemic increased considerably, and in 2022 we’ve seen that number grow to $18 trillion. With recent economic headwinds, consumers are starting to reduce their savings rates, with averages in recent months falling from 6% to 4.4%.

Implications for Nonprofits

So what can be gleaned from the current economic climate that might inform fundraising strategy for nonprofit?

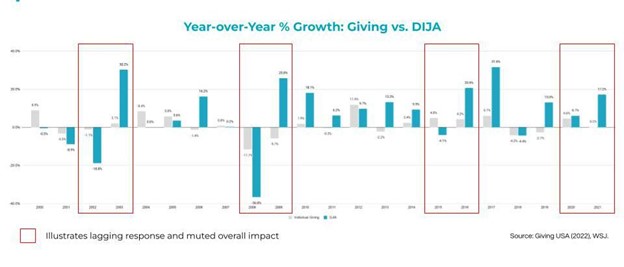

As we look at previous trends in nonprofit giving since 1990, a steady trend of growth is observable. The data also shows us what happened to nonprofit giving during the last three recessions in 1990, 2001, and 2008. In the last three recessions, giving decreased in the year of and the year following a recession.

● In 1990 giving was down 5.7% and .5% in 1991.

● In 2002 the decrease was 3.3% and 1.1%

● In 2008 the decrease was 11.7%, and 5.7% the year following.

That being said these decreases are fairly muted when compared to overall giving during the 30-year span and overall giving increased.

During a recession, losses in the market tend to far outpace declines in philanthropic giving. That is to say that giving does not tend to show the same volatility in a downturn as the market. Giving has been shown to be highly correlated to GDP, so that may be the better economic metric to keep an eye on.

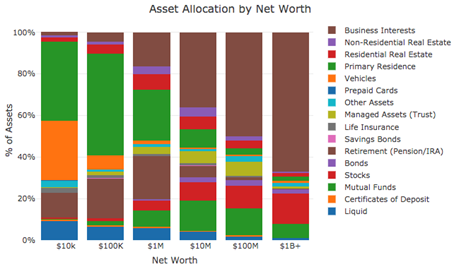

Despite the stock market minimally impacting individual giving, consumer wealth shrinks in a recession overall. That said, affluent populations (and major donors) may be less impacted by a market downturn, as asset allocations are more diversified across asset classes.

With all of this being said, and despite the impact on giving likely being small, giving does decrease during a recession and will impact nonprofit budgets in the coming years. So what can we do to set ourselves up for success in the face of a possible recession? Here are our five recommendations.

Data-Driven Strategies for a Volatile Market

Most organizations are not data-driven. It’s a harsh statement but true and to be successful during difficult times for fundraising, you must be efficient. This is where having a data-driven organization will set you up for success, and we are going to tell you how to do it.

Any data-driven organization must start by building a foundation of trustworthy data. Oftentimes there is overlapping data across disparate systems within an organization. Donor and prospect data, CRM data, transaction data, volunteer data, email data, and more. There are often competing data from various departments and locations like regional data at hospitals and universities, all inputting it into a central location. Organizations must first unify the data and enrich it, whether it be with third-party or wealth screening data, to then enable action. Many organizations will go straight to the major gift programs or outreach, but that will be very difficult without all the information about your ideal donor.

Once a foundation of trustworthy and unified data is laid, it’s time to augment your data with deeper intelligence and insights. Doing this helps you develop a 360-degree view of what characteristics define your ideal donor. You should be asking yourself questions like “what is their wealth, likelihood to give, engagement, geographic location, or cohort?” “What is their donation threshold?” “What are our benchmarks, and are the success metrics achievable?” The more you can identify about your donor, the more targeted and efficient you can become at finding more individuals like them. There may be a substantial area of untapped opportunity within that segment.

It’s given, even necessary, that your organization has a sizeable dataset. With already stretched resources, combing that data and drawing conclusions from that data will undoubtedly be an expensive and time-consuming process. That’s why it’s important to leverage AI and Machine Learning to drive strategic processes. Leveraging AI can help streamline operations. If you build a model for your organization and its specific goal it WILL help you reach your goals more quickly. With predictive modeling your organization can point out individuals with a higher propensity to give, allowing your team to prioritize those individuals in their fundraising efforts.

When there is a consensus that the data you’re using works and is trustworthy, it’s time to take action across the organization. Start to roll out improvements in your data-driven strategy in a phased approach. Prove to stakeholders that the data works and show how it can increase success rates among your gift officers. This is an opportunity to try it across other channels and measure. Another way to do this is to try the 80/20 rule. Have your team spend 20% of their time focused on these AI-derived audiences and see how it compares to where they are spending the other 80% of their time. It’s important now to orchestrate enhancements across the organization and loop engineering, as this process will require their help.

The final step in this process is to analyze, measure results, and continue to iterate. This is an ongoing process. Data changes, and as you refresh and organize your data (as you should be), you can maintain and refine the process. In this phase, it’s important to continue to train your team on this process and refine your KPI’s as you hone in on your ideal cohorts.

The state of the economy and its outlook remains uncertain, but there are a lot of signals impacting consumers. For us in the nonprofit world, there are others things we can take into consideration. Wealth is not all tied up in the stock market, luckily for us. We also have some cutting-edge tools at our disposal we didn’t have in the prior recessions, in addition to the fact that there is a lot of cash in people’s pockets right now. Screen your entire database. Make sure you look at identification, segmentation, and engagement strategy. With a large list and limited resources, look at propensity modeling and machine learning to get the most “bang for your buck.” Continue to improve and iterate while keeping an eye on your success metrics. As the world changes around us make sure you update and refresh your data and your goals to continue and ensure the success of your team.